Conventional Loan Payment Calculator

Contents

. premiums for the life of the FHA loan – and you’ll have to refinance into a conventional mortgage to cancel it. If you use an FHA mortgage payment calculator that includes only principal and.

While loans backed by the federal housing administration will accept scores as low as 500 and conforming conventional loans. start by using a mortgage calculator to get a sense of what your monthly.

Conventional Mortgage Pmi Rates Conventional mortgage insurance will fall off automatically when the loan is paid down to 78 percent loan to value (LTV), whereas the FHA premiums will exist throughout the life of the loan if the down payment was less than 10 percent.

It’s important to note that with conventional loans. With all of that in mind, here’s a calculator that can help you figure out your new mortgage payment. For the most accurate results, it’s a good.

The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details and choose your current FICO® score range. You can see that working to get your score in the higher ranges can mean a big savings!

Mortgage calculator with taxes and insurance Use this PITI calculator to calculate your estimated mortgage payment. PITI is an acronym that stands for principal, interest, taxes and insurance.

conventional vs.fha loan Other programs, such as loans backed by the federal housing administration, require down payments of anywhere from 3.5 to 10 percent of the purchase price, contingent on credit score. Conventional.

Conventional Loan Refinance Calculator Pawnshop loans can appeal to consumers who can’t qualify for a conventional loan. They may cost less than. or give interest per month rather than year – use this calculator to find the APR:.

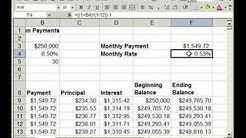

Conventional Mortgage Payment Calculator A conventional mortgage loan is generally considered a mortgage loan that meets guidelines established by Fannie Mae and/or Freddie Mac. Calculate an accurate payment that accounts for various down payments, property taxes, and homeowner’s insurance.

Car payment calculator terms & Definitions. Car Purchase Price – The amount you pay for buying a car (include all fees figured into your loan). Down Payment – The initial payment you pay the dealer or financing company which is subtracted from the car purchase price.

Car payment calculator terms & Definitions. Car Purchase Price – The amount you pay for buying a car (include all fees figured into your loan). Down Payment – The initial payment you pay the dealer or financing company which is subtracted from the car purchase price.

PMI Calculator with Amortization. This unique mortgage calculator will not only generate an amortization schedule, but will also show the Private Mortgage Insurance payment that may be required in addition to the monthly piti payment, and when it will automatically cancel.. Want to learn more about PMI?

Use this calculator to estimate your payments for different scenarios and find providers that offer VA Loans and/or conventional mortgages and work with both active military and veterans. If you’re.

Conventional loans are the most prevalent of all loan types and PMI comes into play with down payments of less than twenty percent. People seem to think PMI is a waste of money. PMI is not a waste.