balloon mortgage amortization

Contents

A balloon mortgage is a type of loan that requires a borrower to fulfill repayment in a lump sum. These types of mortgages are typically issued with a short-term duration. Balloon mortgages may be.

Real Estate Balloons Real Estate Balloon – Toronto Real Estate Career – Balloon payment mortgages are more common in commercial real estate than in residential real estate.[2] A balloon payment mortgage may have a fixed or a floating interest rate. real estate offices, individual realtors and clients from many other industries return to Balloon Bobber enhanced balloons consist of a newly formulated material that.

Mortgage Balloon Payment Calculator – WebCalcSolutions.com – Balloon Payment Calculator (add to your website or run on ours). Calculate balloon mortgage payments (with or without extra principal), balloon payoff amount, and amortization schedule.

Free Excel Amortization Schedule Templates Smartsheet – Balloon Loan Amortization Schedule Template . Use this Excel amortization schedule template to determine balloon payments. A balloon payment is when you schedule payments so that your loan will be paid off in one large chunk at the end, after a series of smaller payments are made to reduce the principal.

Notes Payable Formula Effective interest rate – Wikipedia – The effective interest rate (eir), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the interest rate on a loan or financial product restated from the nominal interest rate as an interest rate with annual compound interest payable in arrears.. It is used to compare the annual interest between loans with different compounding periods like week, month.

Balloon Payments – amortization – amortization.com Ltd. If the outstanding balance is added to any payment in a schedule, the total payment then, is called the balloon payment and the loan is then paid in full. If on Jan 15th 2003 the borrower made a total payment of $680.49 + $123,196.42 that payment would be called the balloon payment and the loan would be paid in full.

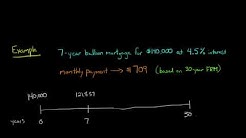

A "balloon mortgage" is a home loan that does not fully amortize over the life of the loan, leaving a large balance at the end of the shortened term. What Is a

Balloon Loan Calculator for Excel – Vertex42.com – The latest versions of the balloon loan calculator (v1.3+) take into account the fact that the regular payment and the interest are rounded to the nearest cent. The "Balloon Payment with Rounding" value is taken directly from the amortization schedule, which ensures that the final balance is zero. Using the Balloon Payment Calculator for Mortgages

Balloon Amortization Calculator – MAFCU Federal Credit Union – Balloon Loan Payment Calculator. This calculator will calculate the monthly payment, interest cost, and balance due on any combination of balloon loan terms – plus give you the option of including a printable amortization schedule with the results.

Using the Balloon Loan Calculator. The Balloon Loan Calculator assumes an amortization period of 30 years – that is, the monthly payments are based on a 30-year payment schedule without a balloon. Start by entering the following information in the appropriate boxes: The loan amount; The loan term (number of years before the balloon payment.

Mortgage Calculator with Extra Payments – Mortgage Amount Enter the amount of the loan. This is the amount from which installments will be calculated and amortization table will be made.

Mortgage Calculator with Extra Payments – Mortgage Amount Enter the amount of the loan. This is the amount from which installments will be calculated and amortization table will be made.